Small Businesses Struggling with Rising Interest Rates

Rising interest rates have been on the radar for many individuals and businesses over the past year since the economy has not fully recovered since the 2008 crash.

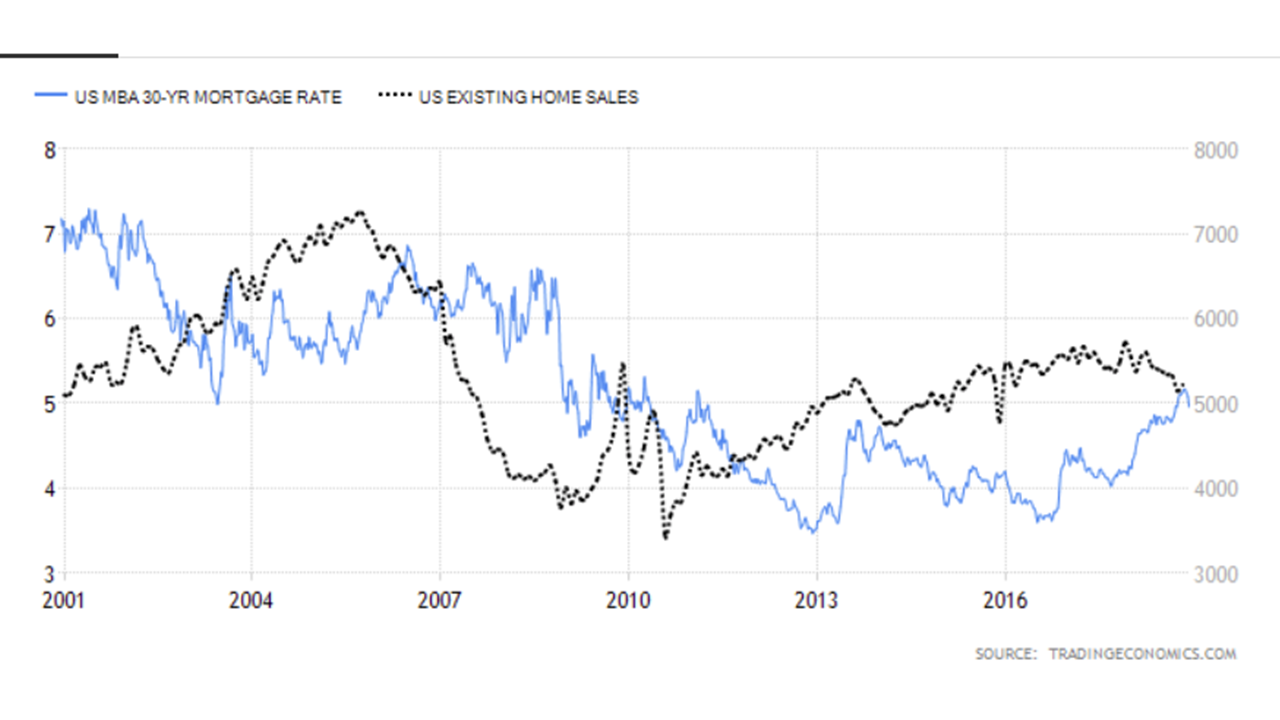

Thank you for reading this post, don't forget to subscribe! The chart compares the 30-year mortgage rate (blue) to US existing home sales (black) from December 2000 through December 2018. You can see mortgage rates flattened out as home sales rose through 2006 and when home sales collapsed in 2007-2008 mortgage rates followed.

The chart compares the 30-year mortgage rate (blue) to US existing home sales (black) from December 2000 through December 2018. You can see mortgage rates flattened out as home sales rose through 2006 and when home sales collapsed in 2007-2008 mortgage rates followed.

As interest rates have been climbing back up more steeply the past two years, home sales have not been able to keep up and have decreased through 2018. There are reports of decreasing rates of personal savings as well.

Property valuations are also taking a hit, as much as 25% lower in some cases, which is making commercial real estate refinancing more difficult. As interest rates rise, the ability to afford properties decreases, causing property values to follow.

So, for business owners that must refinance or renew their business property mortgage, this could cause some serious problems. Rising interest rates are likely to continue into 2019, so this trend could influence businesses within industries that are closely tied to the real estates market such as hotels, restaurants, and manufacturers.

Why would a small business owner need to refinance?

In 2013 many loans were using 5 to 10-year term balloon payments so banks would not suffer from declining property values. Now, these payments are coming closer to their due dates and many business owners choose to refinance. This is not a good situation for those markets which have seen a decline in property value because banks are requiring more principal payments.

If your small business has a solid financial and credit history, an SBA loan may be a good option in this type of scenario. There will not be any balloon payments and you will likely have smaller monthly payments. Plus, SBA loans do not always require collateral.

SBA Loan Requirements

- Loan limit of $5 million

- Business is at least 51% owned by the owner who is a US citizen

- Collateral such as an equipment lien

- The refinanced loan must have terms that are considered “unreasonable” by the SBA – such as high-interest rates and balloon payments.

Interesting Points to Consider

While the housing market seems to be in a slow-down, and a world-wide financial slow down seems to be in the works, the optimism of buyers and business owners about economic growth remains high.

Many business owners are investing in their own businesses, including large corporations in the S&P 500 bought back $583 billion of their own stocks throughout 2018.

Higher interest rates on bank loans will likely put a damper on small business growth over the long run as loans become less affordable, which will then reverse the current positive economic sentiment.

With a global slow down underway, here are a few helpful tips to prepare early:

- It is beneficial to secure financing now while interest rates are lower and lenders are still approving loans at a high rate. If you don’t have a real need for extra financing, you will get better terms and have more options available to you.

- Have a plan for the entire new year with clearly defined goals. Living day-to-day is not an option for long-term success as a small business.

- Keep track of costs even if your business is booming. A slow down always comes, and being prepared with a precise understanding of your bottom line is critical. A financial review at the end of the year is a great time to see what costs are no longer beneficial.